Empower Your Financial Journey with Resolute U

Become the Person Who's Got Their Money Sorted

The Financial Fix isn't just a course—it's your pathway to financial clarity and confidence. Real skills, real strategies, zero overwhelm.

In just 4 months, watch yourself evolve from money-stressed to money-savvy. You'll budget without sacrifice, invest without fear, and build the future you deserve.

Know your money. Lead your life.

Empower Your Financial Future with Resolute U

Become the Person Who's Got Their Money Sorted

The Financial Fix isn't just a course—it's your pathway to financial clarity and confidence. Real skills, real strategies, zero overwhelm.

In just 4 months, watch yourself evolve from money-stressed to money-savvy. You'll budget without sacrifice, invest without fear, and build the future you deserve.

Know your money. Lead your life.

The Financial Fix

FAQ

Who is this course for?

If you're 16–30 and feeling lost with money — this is for you. Whether you're earning your first paycheque, saving for your first home, or trying to make sense of super and investing, The Financial Fix gives you the real-world financial skills you missed at school. No experience needed — just a willingness to learn and take control.

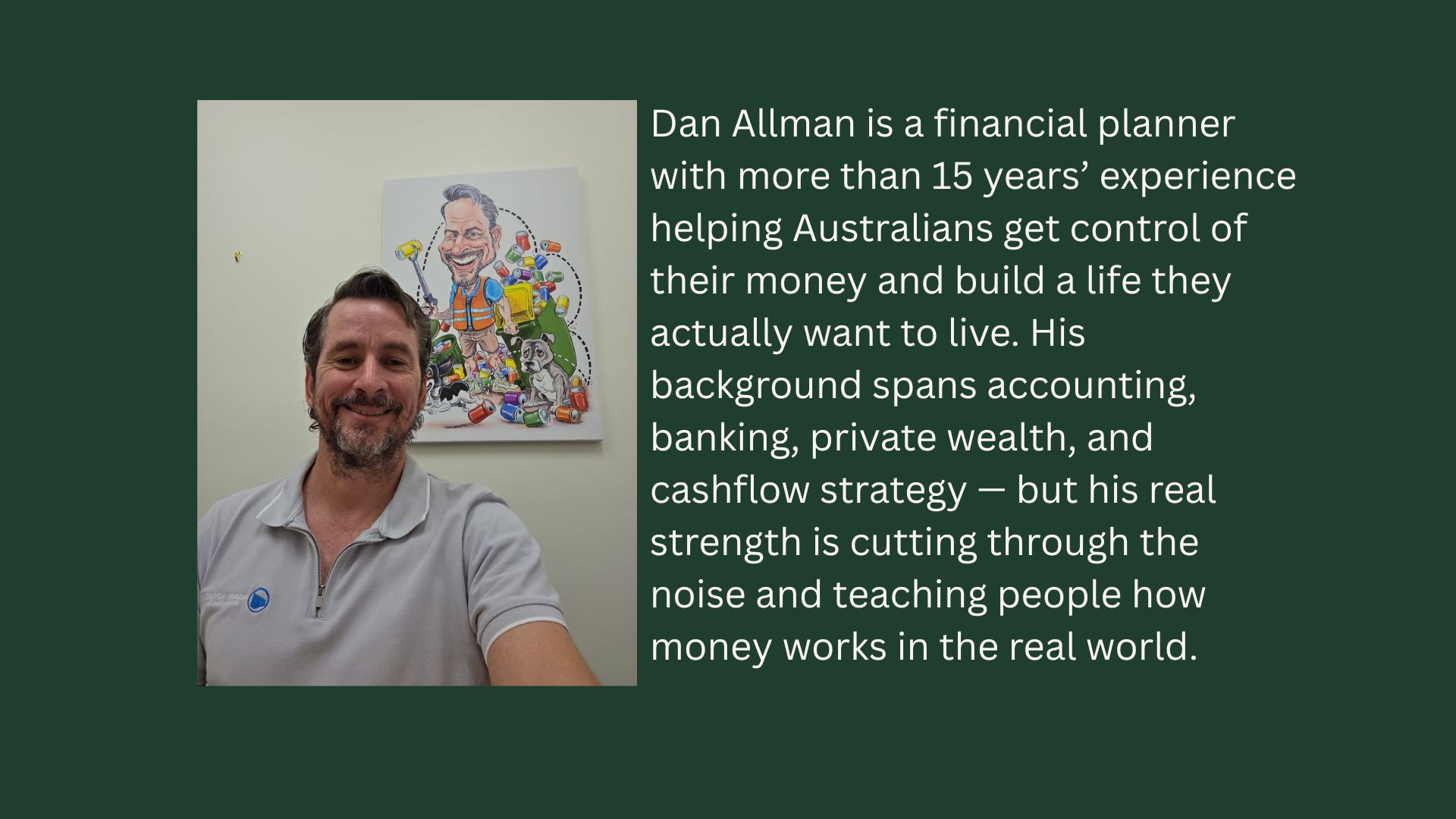

I’m terrible with numbers. Will I even understand this?

Yes! This course is designed to make money make sense. Dan breaks everything down in plain English (with the occasional swear), and we use simple tools, examples, and visuals that actually stick. You don’t need to be “good with money” — that’s what we’re here to teach you.

What do I actually get for $660?

The Financial Fix is a 4-month online program designed to help 16–30 year olds finally take control of their money — and their life. For just $660, you’ll get real results and a lifetime of clarity.

Month 1 – Budgeting & Goals

This is the Foundation Module. We build your custom budget and cashflow system, then tie it to what you actually want in life. Two group Zoom check-ins make sure it works for you.

Month 2 – Superannuation

We decode super: what it is, how it grows, what you’re paying in fees, and how to make it your biggest financial asset.

Month 3 – Shares & Investments

We break down the share market, ETFs, managed funds and even touch on crypto. You’ll finally understand how to invest without hype or overwhelm.

Month 4 – Property

We walk through renting, buying, investing, costs, research and real-world decision-making. No fluff — just the stuff that actually matters.

Do your free Financial Avatar Quiz

This quiz shows you exactly how you deal with money — how you spend, how you think, what you fear, and how you approach risk. No BS, no jargon. In a few minutes you’ll get a clear picture of your financial “avatar” so you can see the patterns driving your results right now. Most people have no idea why they keep repeating the same money habits. This cuts through that and gives you practical next steps matched to who you are. If you want clearer direction, better decisions, and a plan that actually fits you, take the quiz and see where you stand.

Testimonials

I learnt, through making changes to my Risk Profile, I now look to have an extra $600k in my Super

Trudy

I am a successful business owner, but despite my knowledge, I wasn't able to put it into practice. The Financial Fix, allowed me to take control of my finances.

Kate

Get In Touch

Email: [email protected]

Financial Services Guide

Our Financial Services Guide (FSG) explains who we are, the services we provide, how we’re paid, and your rights as a client. It’s designed to give you clear, upfront information so you can make informed decisions with confidence.

Let's connect, follow for more information

Email: [email protected]